michigan gas tax revenue

Federal excise tax rates on various motor fuel products are as follows. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the.

Cream Top Old Style Beer Label C 1940 Beer Label Vintage Beer Labels Vintage Beer

Many states are expected to follow suit and waive the tax customers pay at the pump.

. Call center services are available from 800am to 445PM Monday Friday. 183 cents per federal excise tax. FEDERAL AND STATE FUEL EXCISE TAX EXEMPTIONS.

Currently Michigans tax rate on all types of fuel is 272 cents per gallon which has come under scrutiny as gas prices have soared in response to the war in Ukraine. 0219 gallon Most jet fuel that is used in commercial transportation is 044gallon. Gretchen Whitmer vetoes it.

Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. It will remain in place until at least the end of the year. And replace state highway commission with transportation commission.

Motor Fuel Tax Mi. While Michigan has now waived the sales tax on gasoline thats roughly 27 cents per gallon for the 4 gas it isnt the only one. 120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents.

City Individual Income Tax Notice IIT Return Treatment of Unemployment Compensation City Business and Fiduciary Taxes. 30 and is expected to result in a revenue loss of. How is this tax calculated.

In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. 1 unless Democratic Gov. 263 cents per Michigan motor fuel tax.

Revenue from Michigans 27-cent excise tax on gas goes into the states transportation fund which is divvied up among state trunk lines cities and villages and county road commissions. Pennsylvania the state that had the highest gas tax last year saw the highest gas tax increase of 79 cents per gallon the final increment of a 2013 law. The steep increase in gas prices over the years has been everyones hot topic.

Michigan House lawmakers approved a Republican-backed plan 63-39 Wednesday to suspend the states 272 cent-per-gallon gas tax for six months a move aimed to provide tax relief for motorists. You can see the latest news on this on our homepage. 2015 PA 179 earmarked 1500 million of GFGP income tax revenue to the Michigan Transportation Fund in FY 2018-19 3250 million in FY 2019-20 and 600 million in FY 2020-21 and each year thereafter.

52 rows The current federal motor fuel tax rates are. Fund 026 Michigan Sales Tax 014 School Aid Fund 0103 Const. 0183 per gallon.

The revenue michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to. AP The Republican-led Legislature voted to suspend Michigans 272-cents-a-gallon gasoline and diesel taxes amid pump prices exceeding 4 per gallon. If a gallon of gas at the pump sells for 256 cents then 22 of the price is composed of federal and state taxes.

Liquefied Natural Gas LNG 0243 per gallon. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a.

0263 represented the Michigan gasoline tax 0184 represented the Federal gasoline tax and 0141 represented the Michigan sales tax. The Michigan Gas Tax Amendment Proposal M was on the 1978 ballot in Michigan as a legislatively referred constitutional amendmentIt was approvedProposal M allocated at least 90 of gas tax revenues for general road purposes and the remainder for other transportation purposes. Sales tax revenue in december 2021 was up 149 from the december 2020 level and.

The fuel was used on a farm for farming purposes in carrying on a trade or. The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to. But that was based on.

The gas tax proposal pushed through the House Wednesday on a 63-39 vote would suspend the states 272-cent gas tax from April 1 through Sept. GOP leaders announced. The Michigan Senate this week gave final approval to a bill that would suspend the states 272-cents-per-gallon gas tax for six months but the Republican majority did not have enough votes to give the bill immediate effect meaning it would not cut prices until 2023.

The bill expected to earn approval from the GOP-controlled Senate next week would take effect Apr. Michigan collects an average of 379 in yearly excise taxes per capita lower then 70 of the other 50 states. Michigan per capita excise tax.

The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the. Figure 3 Crude Oil 146 Refining 034 DistributionMarketing 035 Federal Motor Fuel Tax 018 Mi. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they wrote.

COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed. Michigan General Excise Taxes - Gasoline Cigarettes and More Michigan collects general excise taxes on the sale of motor fuel gasoline and diesel cigarettes per pack and cell phone service plans.

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Michigan S Gas Tax How Much Is On A Gallon Of Gas

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Sales Tax Where Does The Revenue Go And What Could An Increase Mean For Road Funding Mlive Com

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Lawmakers Push New Proposal That Would Pause Gas Tax This Summer

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Michigan Gas Tax Going Up January 1 2022

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Financial Information Ottawa County Road Commission

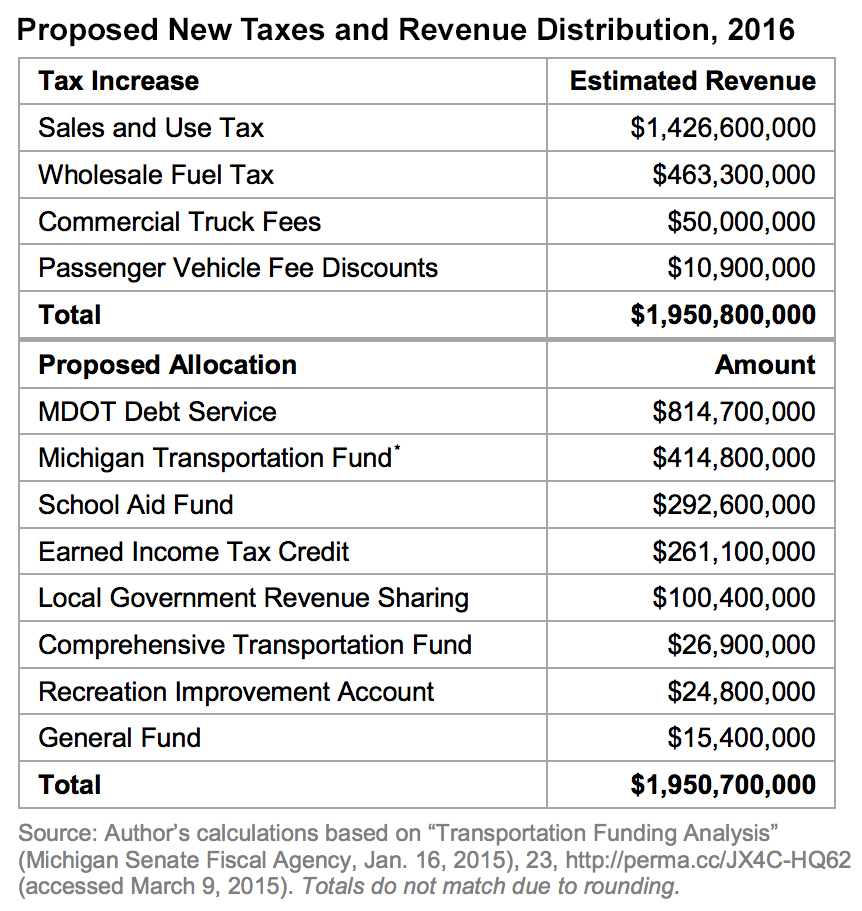

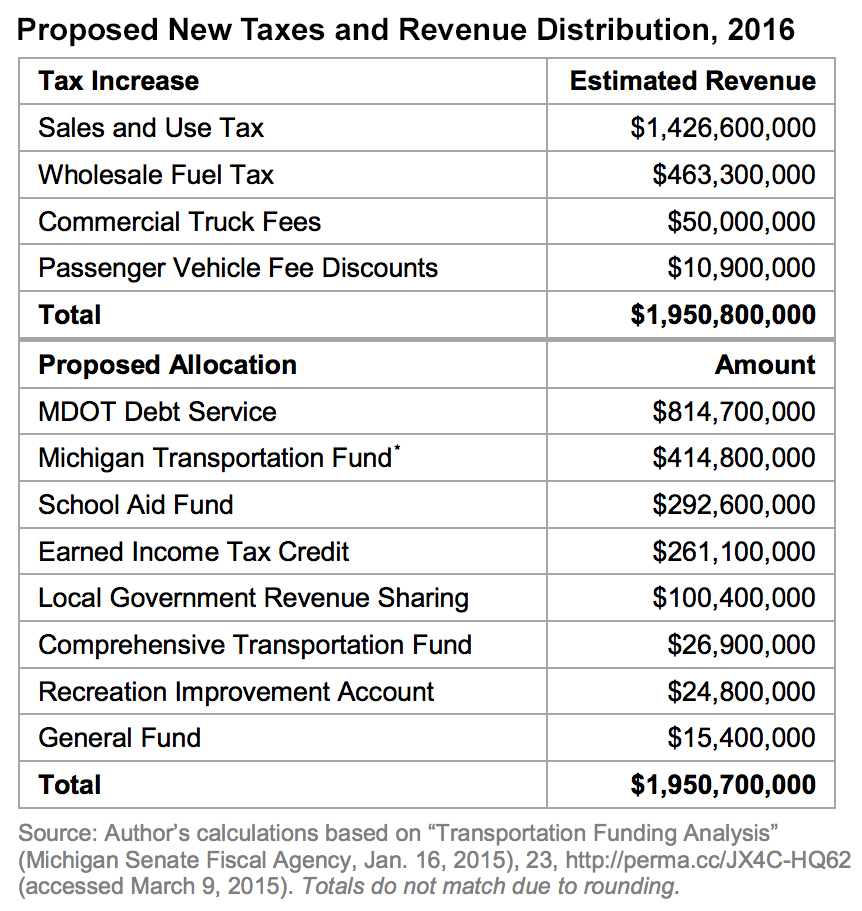

Michigan S May Tax Proposal Mackinac Center

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Whitmer Calling On Congress To Suspend Federal Gas Tax As Prices Skyrocket Macomb Daily

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump